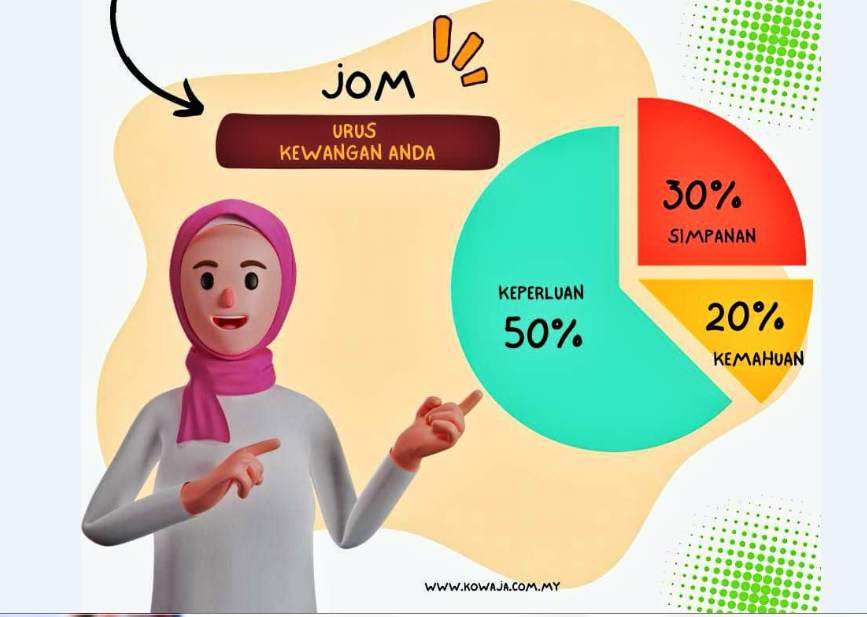

Finance is a very important aspect of life and everyone needs to plan their own finances. The concept of personal financial management itself is actually very simple, expenses should not exceed income and savings should be set before spending. There is no doubt that money is a very important medium in our daily lives. However, we as humans often make mistakes in managing money to the point that it not only haunts the low-income group, but even those with relatively good incomes cannot escape from financial management problems.

Not managing your finances wisely can have many negative consequences. Individuals may face debt problems, lack of cash, and difficulty in meeting basic needs. Additionally, they may not be able to achieve long-term financial goals such as buying a home, investing in education, or a comfortable retirement. Loss of financial control can also cause anxiety, stress and high mental pressure. Finally, greater adverse effects include the risk of bankruptcy and loss of property, and may affect the future lives of individuals and families. Therefore, it is important to manage finances. However, we must discipline ourselves to ensure that every plan made can be implemented. Here are some tips that can be used as a guide in financial planning.

- Make sure every time you receive a salary that part of the money to be saved is kept in a special account.

- Plan your finances carefully. Create a special personal spending plan that covers daily, weekly, monthly expenses up to annual expenses.

- Avoid getting into debt except to buy things like cars and houses. If you can’t afford it, it is recommended that you postpone your wish until you are really able.

- Practice the attitude of listing the items you want to buy before stepping into the shopping center to prevent you from spending money on unimportant items.

- Never spend more than you earn and it will only cost you later.

- Make sure you have a special savings to use in case of emergency.

Having an organized and detailed financial plan, individuals can manage income, expenses, debt, and investments more effectively. A good financial plan can help individuals achieve their financial goals in the short and long term. Overall, by having an organized and detailed financial plan and taking action in starting your own financial plan, individuals can achieve their financial goals and improve their quality of life.